montana sales tax rate 2019

Montana has seven marginal tax brackets ranging from 1 the lowest Montana tax bracket to 69 the highest Montana tax bracket. Maricopa County Local General Sales Tax AZ State Sales Tax Apache Junction 400 560 Avondale 320 560 Buckeye 370 560 Carefree 370 560.

State Corporate Income Tax Rates And Brackets Tax Foundation

Montana has a progressive state income tax with a top rate of 69.

. State Reduced Food Tax-01012019. Montana charges no sales tax on purchases made in the state. While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases.

Of this the state allocated 5 million in state funds to tobacco prevention in fiscal year 2019 34 of the Centers for Disease Control and Preventions annual spending target4. Legislative Fiscal Division. There is no sales tax in the state and property taxes are below the national average.

Alabama lawmakers in 2019 approved the increase on gasoline and diesel fuel taxes to fund road and bridge construction. The cities and counties in Montana also do not charge sales tax on general purchases so. WHO PAYS THE INDIVIDUAL INCOME TAX.

Of Income 139 100. If your taxable income Form 2 page 1 line 14 is. Learn about Montana tax rates rankings and more.

Home Taxes Fees. Sales tax rates differ by state but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. 1 A sales tax of the following percentages is imposed on sales of the following property or services.

State Sales and Use Tax-07012013. 2019 Montana Individual Income Tax Rates. There are no local taxes beyond the state rate.

Montanas top rate 69 is levied when a persons income is beyond 14900. The Mountain View California sales tax rate of 9125 applies to the following five zip codes. As of 2019 our research has found that five states have 0000 sales tax.

An alternative sales tax rate of 9125 applies in the tax region Los Altos which appertains to zip code 94040. Its sales tax from 595 percent to 61 percent in April 2019. The increase amounts to 6 per month for a person who uses 15 gallons of.

Montana SUI Rates range from. State Electricity Manufacturing Tax. 94039 94040 94041 94042 and 94043.

Montana is ranked number twenty nine out of the fifty states in order of the average amount of property taxes collected. The state sales tax rate in Montana is 0000. Montana taxes are below national averages at all income levels.

3100 1 of taxable income. Montana received 1085 million estimated in revenue from tobacco settlement payments and taxes in fiscal year 20194. The District of Columbias sales tax rate increased to 6 percent from 575 percent.

Sales tax rate differentials can induce consumers to shop across borders or buy products online. Smoking-caused losses in productivity. Alaska Delaware Montana New Hampshire and Oregon do not.

The state sales tax rate in Montana is 0000. Montana tax rate is unchanged from last year however the income tax brackets increased due to the annual. 2020 Montana Individual Income Tax Help Form.

Sales tax rates differ by state but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. Montana state income tax rate table for the 2019 - 2020 filing season has seven income tax brackets with MT tax rates of 1 2 3 4 5 6 and 69 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Collected in fiscal year 2019 accounted for 56 of General Fund revenue.

But not more than Then your tax rate is. In 2020 Montana ranked 26th in 2019 Montana ranked 25th in 2016 Montana ranked 24th in 2014 Montana was ranked 15th among states taxing at the individual level and in 2005 Montana was ranked 26th. Some businesses also pay taxes through the individual income tax because the income.

Your taxable income is 25000. The Montana sales tax rate is currently. Sales tax rate differentials can induce consumers to shop across borders or buy products online.

Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in. You can find information on filing paying and complying with the more than 30 taxes and fees we administer. Montana has only a few other types of taxes.

The individual income tax is paid by Montana residents and nonresidents with income taxable in Montana. 5400 2 of taxable income. Total Tax Burden by Income Level The estimated burden on a family of three of all personal taxesincome property general sales and auto taxesis provided in the tables below for three different income levels.

Combined with the state sales tax the highest sales tax rate in Montana is 5 in the cities of Sidney Fairview Westby and Biddle. The median property tax in Montana is 146500 per year for a home worth the median value of 17630000. Montana Code Annotated 2019.

The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0. Explore data on Montanas income tax sales tax gas tax property tax and business taxes. Montanas top rate 69 is levied when a persons income is beyond 14900.

Counties in Montana collect an average of 083 of a propertys assesed fair market value as property tax per year.

States With Highest And Lowest Sales Tax Rates

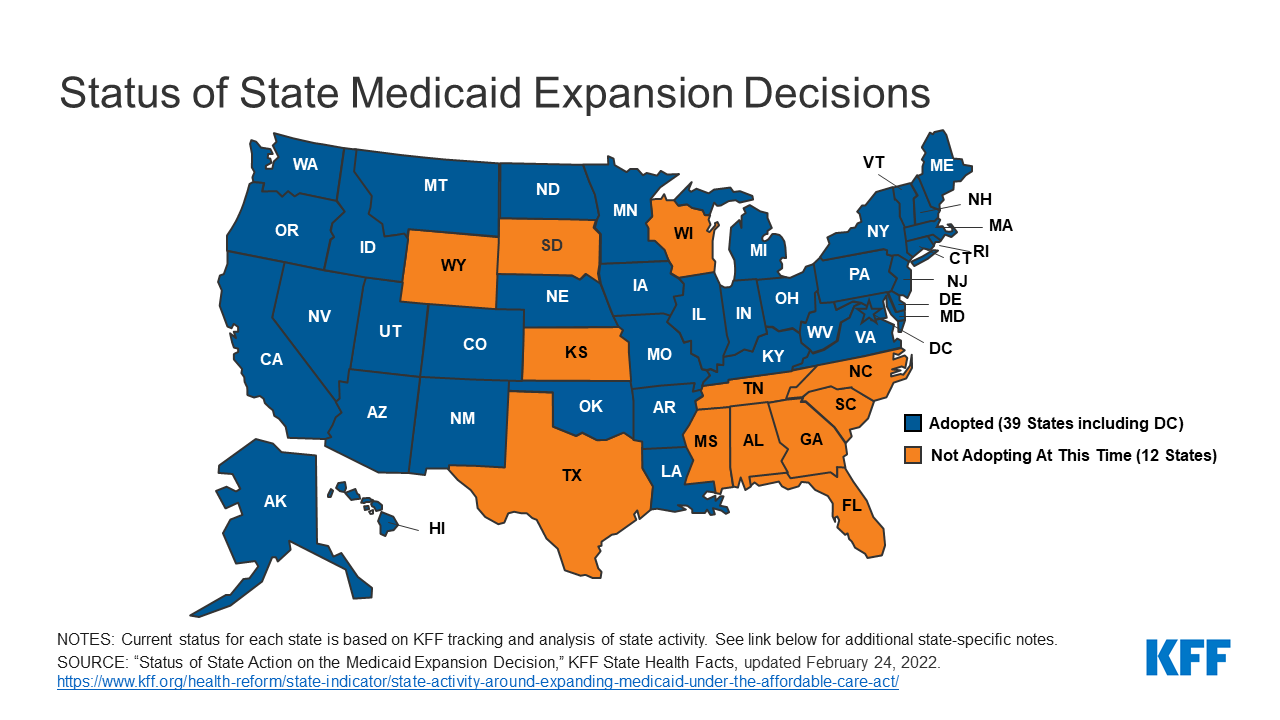

Status Of State Medicaid Expansion Decisions Interactive Map Kff

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State Income Tax Rates And Brackets 2022 Tax Foundation

States Without Sales Tax Article

Montana State Taxes Tax Types In Montana Income Property Corporate

Study Reveals Most Least Tax Friendly States How California Compares Ktla

Montana State Taxes Tax Types In Montana Income Property Corporate

Montana State Taxes Tax Types In Montana Income Property Corporate

How Do State And Local Sales Taxes Work Tax Policy Center

Salestaxhandbook The Comprehensive Sales Tax Guide